How to create “Magic Money”

Most people have no idea that they can increase the money will leave behind for family or charity without dipping into their pocket. Is it magic? Not at all. Read on……

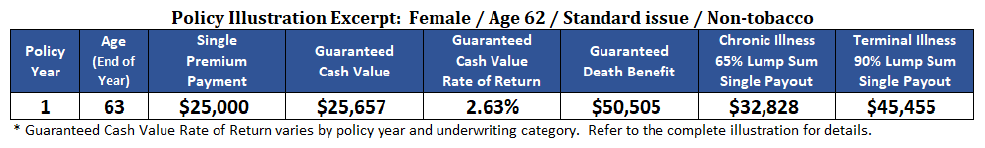

If you are under 85, you could choose to move money into a single premium life insurance policy and watch the money immediately increase. The only way to do this is using life insurance but although this type of policy has been around for years, it’s not like what you’ve ever seen. And don’t fear the insurance aspect as you can get your money back anytime. It’s still your money. But the magic happens with the benefit.

We use a single premium life insurance policy to “create” more money. However, unlike other policies where you make monthly or annual payments, you simply move funds from other sources such as a bank or mutual funds into a policy that you own and control.

Four Fantastic Tax Benefits for You and Your Beneficiaries

- A tax-free increase in value for your beneficiaries.

- A tax-free transfer to your specifically named beneficiaries without any publicity or probate costs.

- Tax-free payouts for qualified chronic illnesses or terminal illnesses.

- A money-back guarantee on the tax-deferred cash while you’re alive.

You can receive at no additional cost Living Benefits in which you may be able to withdraw tax-free money for qualified chronic illnesses, including Dementia & Alzheimer’s disease, and terminal illnesses paid in a lump sum up to 90% of your amplified death benefit amount.

We like saying No: No needles, no bodily fluid tests, no physical examination, no one coming into your home, no long wait times. No policy fees, no administrative fees, no additional premium costs. No stock and no bond market index. Know what your future coverage looks like with our guarantees.

This is what one of our highly rated companies offers.

Please note that a one-time deposit of $25,000 becomes a $50,505 guaranteed death benefit which passes on to your family, charity, or any beneficiary of your choice tax free

Contact me for more information and a personal illustration. No obligation, of course.

or Leave Me A Message